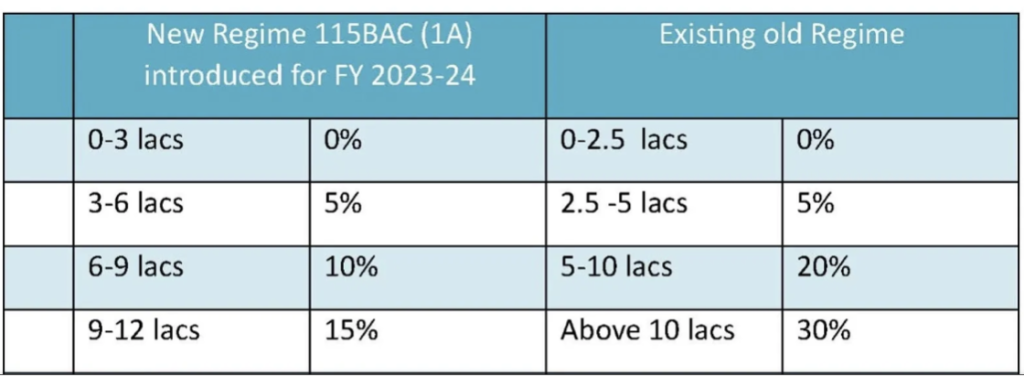

The new financial year commenced from April 1 with the new tax regime coming into force from the said date. It’s crucial for taxpayers to understand the income tax rates and slabs applicable to them, both in the new and old income tax regimes. It’s noteworthy that for the fiscal year 2024-25, the new income tax regime has become the default option. Therefore, if you prefer the old tax regime, you must notify your employer at the outset of the financial year to ensure your income tax calculations align accordingly.

Starting from April 1, 2024, the new tax regime, initially introduced as an alternative in FY 2022-23, will transition into the default option. Consequently, your taxes will be assessed and implemented automatically under this new tax system, unless you expressly choose to adhere to the previous tax structure.

Here are a few points to be considered:

1. The difference in basic exemption limits exists between the old and new tax regimes. If an individual’s earnings fall below the basic exemption limit within a financial year, their income becomes exempt from taxation. Presently, under the new tax regime, income up to ₹3 lakh remains tax-exempt. This exemption applies universally to all individuals who opt for the new tax regime, irrespective of age.

Conversely, within the old tax regime, the basic exemption limit varies depending on the individual’s age. For those below 60 years of age, income up to Rs 2.5 lakhs in a financial year is exempt from tax. For senior citizens aged between 60 and 80 years, the exemption extends to Rs 3 lakh annually. Super senior citizens, aged 80 years and above, enjoy an exemption for income up to Rs 5 lakh within a financial year.

2. Under both tax regimes, income tax laws provide tax rebates to resident individuals. This rebate, governed by Section 87A, ensures zero tax payable if the net taxable income falls below the specified threshold. Notably, the new tax regime offers a more substantial tax rebate compared to the old tax regime.

In the new tax regime, individuals can avail a tax rebate of up to ₹25,000, resulting in zero tax payable for incomes up to ₹7 lakh. Conversely, the old tax regime offers a tax rebate of up to ₹12,500, allowing zero tax payable for net taxable incomes up to ₹5 lakh.

Despite its attractiveness following the Union Budget 2023-24, the new tax regime does not include the standard deductions available in the old tax regime.

3. Since the inception of the new tax regime in the fiscal year 2020-21, a deduction has been available for contributions made by employers into employees’ Tier I NPS accounts. Income tax laws outline the maximum deduction permitted for both private and government employees.

Private sector employees can claim a deduction of up to 10% of their salary, while government employees can claim up to 14% of their salary under Section 80CCD (2). As per income tax regulations, salary encompasses basic pay plus dearness allowance.

Ordinarily, the employer’s contribution to an employee’s Tier I NPS account is considered part of the employee’s cost to the company (CTC), potentially reducing the employee’s take-home pay. The employer’s NPS contribution is factored into the gross salary payable by the employer. Employees must claim the deduction under Section 80CCD (2) when filing their income tax return (IT). Details regarding the employer’s contribution to the NPS account can typically be found in Part B of Form 16.

Employees are not required to furnish proof of NPS contribution to avoid higher Tax Deducted at Source (TDS) from salaries, as the contribution is directly made by the employer to the NPS account, similar to Employees’ Provident Fund (EPF) contributions. However, employees should verify their employer’s policy regarding proof submission.

4. To be assessed under the old tax structure, individuals must expressly indicate this preference at the outset of the year. Salaried taxpayers retain the flexibility to switch between the old and new tax regimes each fiscal year. However, individuals earning income from business and profession have a one-time opportunity to change. In other words, if such a taxpayer opts for the new tax regime, they are limited to a single return to the old tax system. The new tax regime applies to individuals other than companies and firms and has become the default option from the Financial Year 2023-24. Correspondingly, the Assessment Year linked to this is AY 2024-25.

Furthermore, this choice between the old and new tax regimes is only applicable if the tax return is submitted by the due date. Failure to file by the deadline necessitates adherence to the default system, which is the new tax regime.

5. Under the new tax regime, high-income earners opting for it will encounter a lower surcharge rate. This rate has been decreased from 37% to 25% for incomes surpassing Rs 5 crore. Conversely, if an individual chooses the old tax regime, they will be subject to a surcharge rate of 37%.