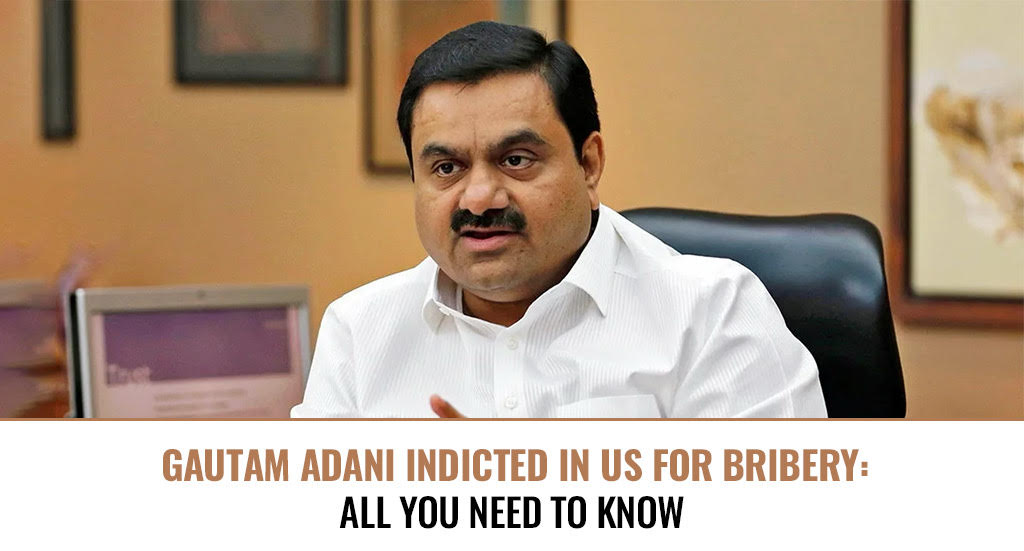

The US government has issued a five-count criminal indictment of Gautam Adani, chairman of the Adani Group, and many of his business associates for allegedly offering more than $250 million in bribes to Indian government officials to obtain solar energy contracts, conspiracies to commit securities and wire fraud, and planning “a multi-billion dollar scheme” to deceive US investors and global financial institutions by giving false statements. The Adani Group has denied the allegations, dismissing them as “baseless”.

The charges have had an immediate ripple effect, forcing the Adani Group to abruptly cancel its $600 million bond offering just hours after pricing. The scandal also caused Adani’s US dollar bonds to plummet in Asian trading, with the company’s stocks dropping as much as 20% in intra-day trading on November 21.

This unfolding controversy has not only cast a shadow over the reputation of one of India’s largest conglomerates but has also raised questions about corporate ethics and governance in the global business landscape.

The Adani Bribery Case: Allegations and Fallout

The US Securities and Exchange Commission (SEC) has charged Gautam Adani, his nephew Sagar Adani, and Cyril Cabanes of Azure Power Global Ltd, alongside several senior executives of Adani Green Energy with orchestrating a massive bribery and securities fraud scheme. Adani is accused of securing the Indian government’s commitment to purchase solar energy at above-market rates, benefiting Adani Green Energy and Azure Power.

Key Allegations

1. Fraudulent Scheme: The group allegedly devised a multi-billion-dollar scheme to mislead US investors and global financial institutions using false statements.

2. Bribe Payments: Approximately $265 million in bribes were reportedly paid to the Indian government officials, primarily in Andhra Pradesh, to secure contracts promising $2 billion in profits over 20 years.

3. Concealment: The bribes were hidden from investors and lenders, enabling the group to secure $3 billion in loans and bonds for Adani Green Energy.

4. Code Names: To disguise their activities, encrypted communication and code names like “Numero Uno” for Gautam Adani were used.

Legal and Financial Fallout

- FCPA Violations: The charges, made under the Foreign Corrupt Practices Act (FCPA), could lead to severe legal consequences, including substantial fines and penalties.

- GQG Partners’ Response: Investment firm GQG Partners, a stakeholder in Adani Group companies, is monitoring the situation and considering portfolio adjustments.

Broader Context

Gautam Adani, the chairman of Adani Group, is reported to have leveraged his political ties, particularly with Indian Prime Minister Narendra Modi, to secure profitable contracts, including control of airports. The US bribery case against Adani involves a scheme from 2019-2020, where Adani Green Energy secured a $6 billion solar contract but struggled to sell the expensive energy. Adani and his associates allegedly paid $265 million in bribes to Indian officials to secure deals. The charges include violations of the Foreign Corrupt Practices Act (FCPA) for bribing foreign officials.

This case adds to the Adani Group’s ongoing troubles, following accusations of stock manipulation and fraud by Hindenburg Research in 2023, which led to a $150 billion loss in market value and raised concerns about the group’s governance and ethical practices.

This latest legal challenge adds to the mounting scrutiny surrounding Gautam Adani and the Adani Group, further damaging its reputation on the global stage. As investigations continue, the case underscores the growing concerns about corporate ethics, governance, and the influence of political connections in securing business deals. The outcome of these proceedings could have far-reaching implications for both the Adani Group and the broader business landscape, particularly regarding the enforcement of anti-corruption laws and the transparency of multinational operations.